10/03/2025 08:52 am MYT

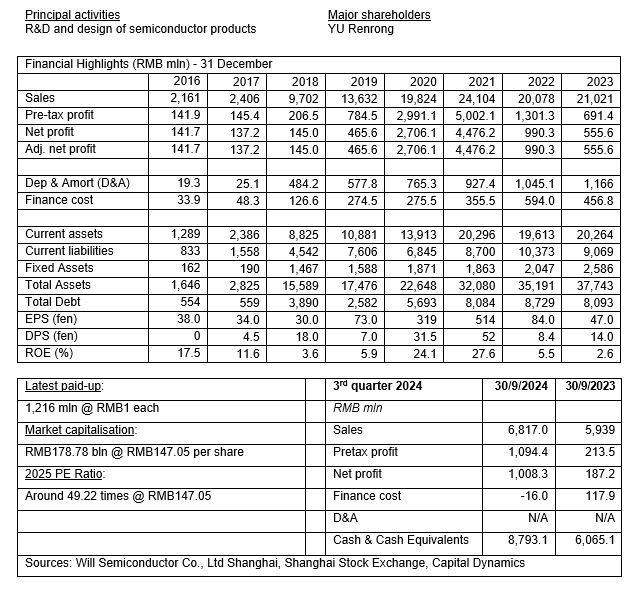

This week, i Capital features Will Semiconductor Co., Ltd Shanghai (Will Semiconductor) (韦尔半导体), one of the top 10 fabless semiconductor companies in the world according to TrendForce, a market intelligence firm specialising in the technology sector. In 2007, the Company was established in Shanghai by Mr. Yu Renrong and Ma Jianqiu. It started as an IC distributor and successfully expanded from an amplifier devices and power IC design business into a CMOS image sensor (CIS), touch & display and analog integrated circuit (IC) one through a series of acquisitions, including that of OmniVision, a leading US company in complementary metal oxide semiconductors (CMOS), the key component of camera modules used in smartphones, automobiles, security, PC and medical devices, etc.

Today, Will Semiconductor is the third-largest CIS company after SONY and Samsung and the second-largest semiconductor player in the automotive segment after Onsemi, the former semiconductor department of Motorola. In 2017, the Company made its IPO on the Shanghai Stock Exchange. In Nov 2023, Will Semiconductor issued and listed its Global Depositary Receipt (GDR) on the SIX Swiss Exchange. As of 2023, the Company had 4,800 employees.

Business model

Will Semiconductor is a fabless company. It focuses on IC design and sales, and outsources the manufacturing process to specialised third-party companies such as TSMC and SMIC. The Company has three business segments: semiconductor design and sales, semiconductor design and services, and semiconductor distribution. Design and sales and distribution are the two largest segments, respectively accounting for around 85% and 14% of 2023 revenue. Design and sales is not only the primary revenue contributor but also one with a gross profit margin of 23.87%, which significantly exceeds the 6.59% GP margin of distribution.

Under design and sales, there are three sub-segments divided according to product categories: CIS, touch & display, and analog IC, among which CIS is the largest, representing around 86.6% of the whole segment’s revenue. Touch & display and analog IC account for 7% and 6.4% respectively. The GP margin of the three sub-segments is 24.03%, 9.48%, and 37.28% respectively. 44% of design and sales r

Note from Publisher

We are only into the third month of 2025, but a lot of major changes have taken place. For one, Donald Trump’s presidency is causing great turmoil around the world. His tariffs have angered many countries, which have vowed or launched retaliations. His policies on Ukraine and the Western European countries are a complete change from his predecessor, creating great uncertainty on the European continent and the Western world. These could have long-term negative repercussions. Before that, the release of DeepSeek’s R1 AI model in Jan has shocked the conceited Western world and intensified competition between US and China. Stubbornly high US inflation rate has led the US Federal Reserve to pause its rate-cutting plan, with no clear sign of when will be its next move. US stocks have lost their lustre while Chinese stocks are now the main attraction.

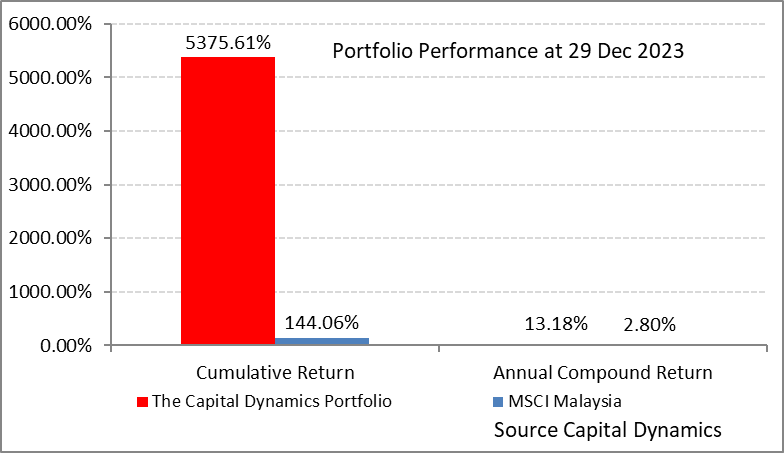

Given the said developments, how should one position his/her investment ? Capital Dynamics is organising a gathering for investors of the funds it manages on 15 Mar 2025. Apart from updating the performance of the funds, participants will hear Teng Boo share his candid opinions on the challenging events mentioned above. This is a precious opportunity to pick Teng Boo’s brain. Please visit https://events.icapital.biz/landing-page/2025-fund-gathering/ to register your participation. Each investor may bring up to 2 guests.

PORTFOLIOS

CORE VALUES

In The Media

STOCK SELECTIONS

SSE | 15 hours, 58 home.stockSelection.minutes ago

WILL SEMICONDUCTOR CO. LTD. SHANGHAI (WILL SEMICONDUCTOR, 603501)

KLSE | 3 days, 3 hours ago

KLSE | 1 week, 3 days ago

IDX | 2 weeks ago